| What year featured an identical calendar year to 2024?

A. 1924 Continue reading to the end to find out the answer! 2024, like any New Year’s Day after a great New Year’s Eve Party, is off to a rather sobering start. The last two weeks of 2023 saw markets move sharply higher on the back of expectations for interest rate cuts as early as March, which led to a significant decline in interest rates as last year ended. The decline in rates spurred a rally in equities broadly, with many underperforming sectors seeking catch-up trades into the close of the year. The late-year move saw the classic “60/40” portfolio essentially close its 2022 performance hole (see chart of the week below). But as Semisonic taught us in “Closing Time,” you don’t have to go home, but you can’t stay here. A sobering tone has been the appropriate way to describe the first trading week of 2024. Markets have come under pressure from better-than-expected employment figures through the week between job openings, jobless claims, and layoff announcements. Combine the data with the minutes from the December FOMC meeting, which indicated a likely peak in interest rates in 2023. However, they were unclear on the timing of rate cuts in 2024 given continued strength in the labor market and economy. This swaying to and fro like a pair of seventh graders at a middle school social will be the “dance” that markets and policymakers perform through the first quarter, with expectations of an initial rate cut quickly moving to March. Stronger than expected economic data will only act like the Nun telling those seventh graders to “leave room for the holy spirit” as cold water continues to be thrown on those expectations, creating a need to reprice expectations via higher interest rates and lower equity prices. So Auld Lang Syne, Happy New Year, and all that jazz. Now it may be time to trade in the champagne for a seat belt, because the first quarter could be a bumpy ride.

1. Job Openings – Job openings nationally came in at 8.79 million vs an estimate of 8.85 million, while the previous report was revised up to 8.85 million from 8.73 million. 2. FOMC Minutes – Minutes from the December FOMC meeting indicated a likely peak in interest rates, with cuts expected in 2024. However, the timing of interest rate cuts was unclear, given comments related to the ongoing resiliency in the economy. 3. Jobless Claims – Initial jobless claims were reported at 202,000 versus an estimate of 216,000.

Monday · Eurozone Retail Sales · U.S. Consumer Credit · Japanese Inflation Tuesday · German Industrial Production · U.S. Small Business Optimism Wednesday · No Significant Data Thursday · U.S. CPI · Initial Jobless Claims · Chinese Inflation Friday · U.K. GDP · U.S. Producer Prices

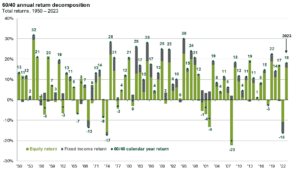

The Death of the 60/40 Portfolio Has been Greatly Exaggerated

And the answer is… C. 1996 1996 had the same calendar year as 2024. Both years began on a Monday, are leap years featuring 366 days, and are election years featuring the Summer Olympics! If you save your calendar for this year (as I’m sure you did with your 1996 calendar), you’ll be able to reuse it again in 2052. |