Axl Rose told us that all we need is just a little patience, but when it comes to investing and the markets, most of us would just prefer a little Paradise City (because the grass is always green there.)

Markets weren’t waiting so patiently for a few things last week. The first was Nvidia’s earnings report, which came out after the close on Wednesday. The second was Jerome Powell’s speech Friday from the Jackson Hole economic forum, where investors were eager to hear any clues as to potential policy strategy for the future with a September Fed meeting roughly three weeks away.

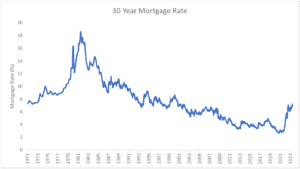

Markets drifted higher early in the week on eagerness for a strong report from Nvidia, given expectations for strength in artificial intelligence investing. Despite a very strong report and the announcement of a stock buyback program, markets gave back most of the gains from the week on Thursday. This was attributed to continued tightness in labor markets with jobless claims coming in below estimates, as well as concerns of a slowdown in housing strength with mortgage rates at multi-decade highs (see chart of the week). In addition, the services sector is showing signs of slowing, and investors are hopeful there may be reason for policymakers to pause on further rate increases. Fed fund futures are now pricing in an 80% probability of no rate increase in September.

So, what are we (and Axl) waiting patiently for next? Well, U.S. employment and inflation data coming out this week will be the next key focus area for investors in assessing the potential policy path for the remainder of this year and into 2024. For the near future, two critical elements will drive market behavior: What the terminal rate for fed funds will be, and anticipation of when interest rates may first be cut.

![]()

- NVIDIA – Anticipation built throughout the week for the AI-focused chip company to report earnings. The company reported revenue well above expectations.

- S. Services PMI – U.S. Services PMI came in at 51.0 vs. estimates of 52.2, indicating services may be beginning to slow nationally alongside manufacturing.

- Jackson Hole – Investors awaited Jerome Powell’s Jackson Speech for any signs of future policy decisions.

![]()

Monday

- Dallas Fed Index

Tuesday

- German Consumer Sentiment

- Case Schiller Home Price Index

- S. Consumer Confidence

- JOLTS / Job Openings

Wednesday

- Eurozone Economic Sentiment

- German Inflation

- ADP National Employment

- S. Q2 GDP Revision

- Wholesale & Retail Inventories

- Japanese Retail Sales

Thursday

- China PMI

- German Import/Export Prices

- Eurozone Inflation

- S. PCE & Personal Consumption

- Initial Jobless Claims

- Chicago PMI

Friday

- K. Housing Prices

- S. Employment / Non-Farm Payrolls

- S. Manufacturing PMI

- S. ISM Manufacturing PMI

![]()

30 Year Mortgage Rate Highest Since 2001

Source: YCharts