The road ahead may be more eventful than originally anticipated.

The action and commentary last week indicate the inflationary struggle between central banks and supply/demand imbalances in the global economy may be more drawn out than originally hoped for coming into this year.

Equity markets, globally, came under pressure throughout last week on further tightening action, and indications from policy makers. The Bank of England’s interest rate increase of 50 basis points, surpassing the expected 25 basis points, along with Jerome Powell’s congressional testimony highlighting the potential requirement of an additional 50 basis points to address persistent inflationary pressures, had a sobering effect on asset prices. Previously, these prices had factored in the likelihood of only a 25-basis point increase in the United States.

Yes, it’s always darkest before the dawn and a watched pot never boils, but collectively we are all waiting for that big sign to indicate that the end is near.

Yield curves in the U.S., U.K., Germany, and Canada all remain significantly inverted. PCE data out late this week will provide the next piece of key information in an ongoing data dependent tug of war between inflation and policy. Comments from Fedex this past week on slowing e-commerce volumes highlight the slowing manufacturing portion of the U.S. economy while services remain robust with continued tightness in services labor. Preannouncements thus far have been minimal heading into second quarter earnings season. Market breadth deteriorated last week where broader measures of the equity markets sold off more than the recent leaders in technology and communications services.

It seems the market backdrop is in a holding pattern awaiting a breakout, one way or another, from the inflation/policy interaction.

- Bank of England – The Bank of England raised interest rates by 50 basis points, which was more than markets expected.

- Powell Congressional Testimony – During his congressional testimony Jerome Powell indicated an additional 50 basis points may be possible in regard to further monetary policy tightening.

- S. Housing – Housing starts, building permits, and other housing related data reported last week point towards a stabilization in the U.S. residential housing market despite 30-year mortgage rates near 7%.

Monday

- German Business Conditions

Tuesday

- S. Durable Goods Orders

- Canadian Inflation

- Case Schiller Home Prices

- New Homes Sales

- S. Consumer Confidence

Wednesday

- No significant data

Thursday

- K. Consumer Credit

- Eurozone Economic Sentiment

- Eurozone Consumer Confidence

- German Inflation

- GDP Deflator

- Initial Jobless Claims

- S. Final Q1 GDP

- Japanese Inflation

- Chinese PMI

Friday

- German import prices

- German Retail Sales

- K. Q1 GDP

- Eurozone Inflation

- S. PCE & Core PCE

- University of Michigan Consumer Sentiment

- University of Michigan 1 year & 5 year Inflation Expectations

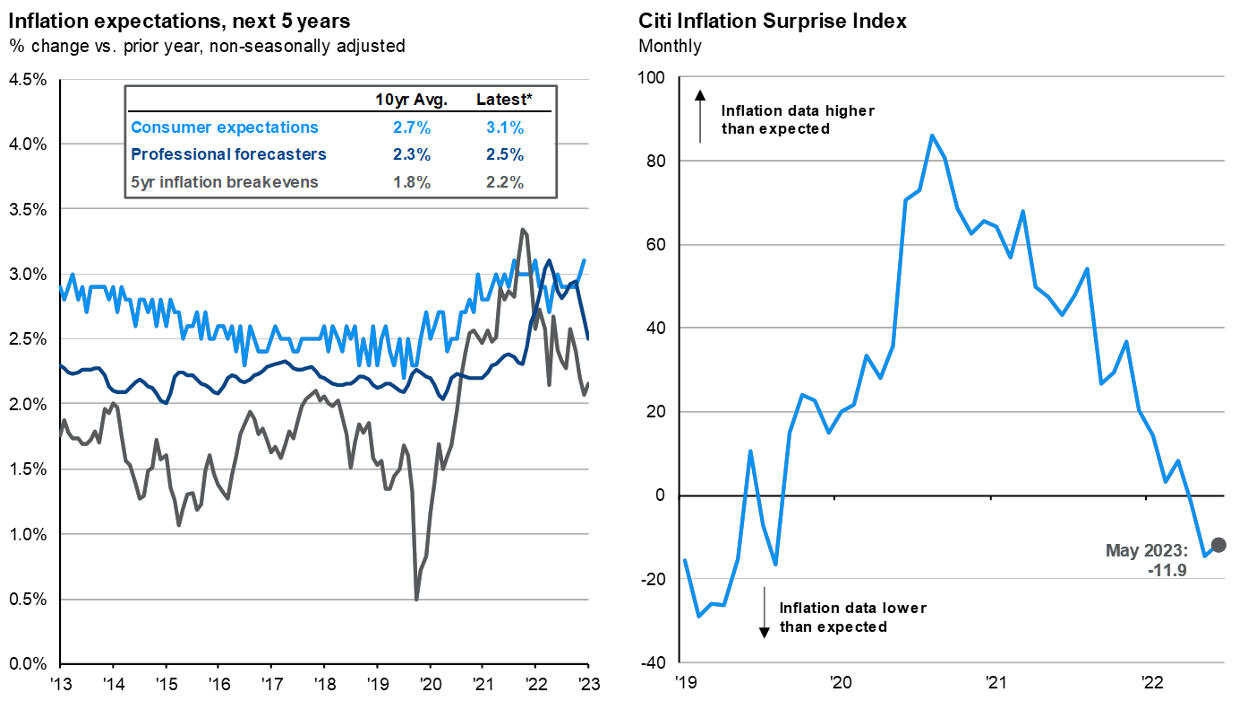

Inflation Surprises in Negative Territory

Source: JP Morgan Guide to the Markets