Clowns to the left of me, jokers to the right. Here I am, stuck in the middle with you. Remember, the popular hit “Stuck in the Middle with You” by the band Stealers Wheel back in 1972? The events of last week felt oddly reminiscent of that song.

The divergence in underlying parts of the global economy between manufacturing and services had us feeling a little stuck in the middle last week given the significant decline in Chinese exports, while ISM non-Manufacturing numbers remain in expansion territory.

Although a slowdown in services is beginning to come through in the data, some of this slowdown may be starting to present itself in labor markets with initial jobless claims coming in higher than expected. Markets would welcome a softer labor market as a way to ease wage pressures and help return inflation to its downward path toward policy targets.

The Bank of Canada’s policy tightening decision last week, after having kept rates unchanged for two consecutive meetings, highlights the challenge central banks face with bringing inflation to stated targets amid a myriad of supply/demand forces at play.

Policy expectations nationally seem to have shifted toward a new base scenario, which includes no interest rate hike at this week’s meeting but does accept that there will likely be one additional policy tightening action in the near future, likely an additional 25 basis points.

But additionally, the expectation of any interest rate cut this year seems to have been removed from market expectations. With this new policy backdrop, focus will remain on labor and wages as a leading indicator for inflation.

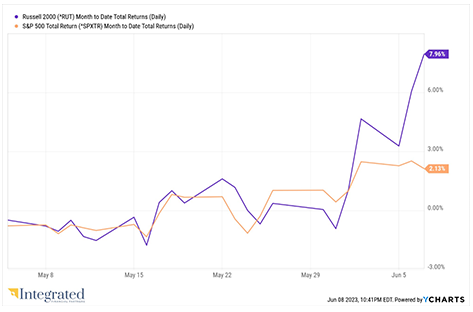

Market behavior in relation to the new backdrop has been interesting in the last week or so with market breadth beginning to increase and small caps attempting to take a leadership position at times. While still too early to declare the beginning of a new market cycle, the rotational aspects of market action in the last two weeks bear watching.

- Chinese Exports – Chinese exports for the month of May came in at -7.5% vs an estimate of -0.4%.

- Bank of Canada – After pausing on their rate increases, the Bank of Canada resumed policy tightening with a 25-basis point increase in reaction to inflation that remains stubborn in its decline.

- Initial Jobless Claims – U.S. initial jobless claims came in at 261,000 versus an estimate of 235,000.

Tuesday

- German inflation

- U.K. Labor & Employment

- Eurozone Economic Sentiment

- U.S. CPI

- U.S. Small Business Optimism

Wednesday

- U.K. GDP

- U.K. Industrial Output

- Eurozone Industrial Production

- U.S. Producer Prices

- U.S. FOMC Rate Decision

- Chinese Industrial Production

- Chinese Retail Sales

Thursday

- ECB Rate Decision

- New York Fed Manufacturing Index

- U.S. Import/Export Prices

- Philadelphia Fed index

- Initial Jobless Claims

- U.S. Retail Sales

- U.S. Industrial Production

Friday

- Eurozone Inflation

- University of Michigan Consumer Sentiment

- University of Michigan 1 yr & 5 yr Inflation Expectations

Strong Start to June for Small Caps

Source: Y Charts