Financial INSIGHT

I hope this letter finds you well. One of the benefits of our independence with our new company is to try to provide you with more timely information. One way I hope to do that is a quarterly newsletter with my thoughts on the market. We realize the market volatility and selloff through the first three quarters this year have been very unsettling. Please know that we are here for you if you want to talk and that we are reallocating portfolios as we go along to try to put the odds in our favor as much as possible.

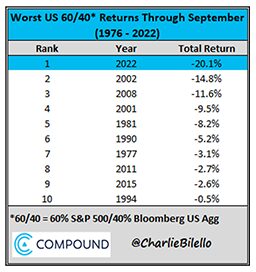

My goal today is is to bring two ideas to your attention – first, that what we have experienced so far this year is uniquely bad, and second, that it’s also perfectly normal. To begin, if this year feels uniquely terrible to you, it’s because it is! In the chart below, you can see the average returns through September of a portfolio that is made up of 60% bonds and 40% stocks, which isn’t too far from what our average client has.

While this year isn’t a historical anomaly, it has been rough in terms of stock prices, and if you own a diversified portfolio of stocks and bonds, chances are this is the worst start to a year you’ve ever experienced (including the Great Financial Crisis of 2008).

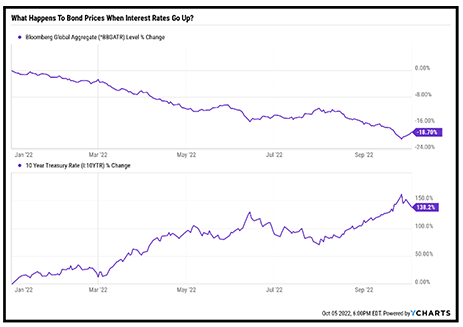

So, let’s talk about bonds. Why has it also been such a bad year for bonds?

Below I have included two charts – the top one shows what has happened to bond prices this year, and the bottom one shows what has happened to interest rates. Why do they have such an inverse relationship? This can be a bit of a counterintuitive concept to understand.

For a simple example, let’s say you bought a 2% treasury bond for $100. Then a few months later, the rates on treasury bonds go up to 4%. So, suddenly that 2% treasury bond you own won’t be worth as much to a bond buyer. You would need to offer a discount to get them interested in your 2% bond, when they could easily just go out to the market and buy a 4% bond instead.

This is what’s happening right now in the bond market. The bonds people bought a year or two ago are trading at a discount to the price they were purchased for, because interest rates have gone up. However, does that mean you’ve lost your money? No!

Let’s go back to the treasury bond example. If you hold onto that bond that you bought until it matures, you will still get back the full $100 that you paid plus the 2% interest per year, even if there was a time somewhere in the middle that the bond might have been trading at a discount. If, at maturity, interest rates are still high, you can go out there and buy a higher yielding bond without having lost any of your money. The moral of the story here is that the worst thing you can do during times like these is to sell your bonds when they are at a huge discount, because then you will mostly likely experience a loss. It requires some patience, but this provides a great opportunity for bond portfolios as new bonds can be added at higher interest rates and old bonds can be held to maturity.

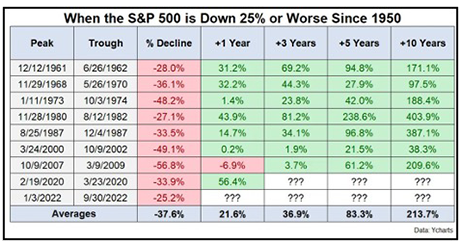

Now let’s talk about the stock market. At the low point so far this year, the S&P was down approximately 24%.1 This makes for a very painful time but it’s not that unusual, when you look at past recessions and bear markets (which is when the market is down more than 20% below a recent high). Check out this historical chart below.

The bad news is that while we don’t think a recession is a certainty, we do think it is quite likely. The good news though is that since World War II, the median recession has had approximately a 24%2 selloff and the average recession has had approximately a 29%2 selloff, so while further downside is possible, if this turns out to be like previous recessions, much of the damage to the market may have already been done.

This brings up another counterintuitive point. Since the stock market is a leading indicator, it often sells off in advance of economic downturns. So, when the economic downturn comes in its full force and things seem like they couldn’t get any worse, the stock market could actually be starting its rally. Think about 2020, for example. The market bottomed on March 23rd when we were still in the early stages of the pandemic. Spring and summer were filled with lockdowns, record unemployment rates, and negative GDP growth, and yet through all that, the stock market rallied because it had sold off in advance and was already pricing in the recovery before it happened. There isn’t much doubt that the US and global economies face a long list of challenges- from inflation to a looming energy crisis in Europe- and yet, the market knows all of that already.

The good news is, going back to the chart above, if you can afford to keep your long-term goals in mind, the years following 25% selloffs have historically yielded excellent returns on stocks.

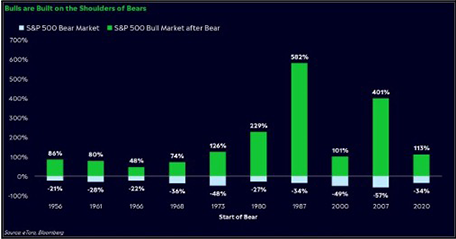

If there was a chart that compared the pain of the losses with the sweetness of the gains, I’m sure it would look nothing like the chart below, but I find it helpful to remember that bear markets have tended to be much shorter than bull markets (when the market is going up). And the losses experienced in bear markets are typically a fraction of the gains made in bull markets.

Warren Buffet once said, “the stock market is a device for transferring money from the impatient to the patient.” As you can see from the chart below, history is on the side of the investor who weathers the pain of the bear markets, knowing that the future bull markets will more than make up for it. As in so many areas of life, if it was easy, everyone would do it, but it’s only the patient that reach their goals when it comes to the stock market.

In conclusion, it has been a very hard year for investors across nearly all asset classes. While there are some unique challenges to this climate for investors, we agree with Sir John Templeton when he said, “the most dangerous words in investing are: this time is different.” While history doesn’t repeat, it does rhyme, and we are practicing patience during this time as well as being opportunistic in making tactical moves where we see them. If you ever want to hear more about how we are thinking about markets and what moves we are making with your portfolio, please give me a call. There are few things I enjoy more than chatting about investments.

-Christian Bryant

1 https://tinyurl.com/ycypeyzh

2 Yahoo Finance

Investment advice offered through Integrated Partners, doing business as Nold Bryant Planning & Investments, a registered investment advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

The information contained in this e-mail message is being transmitted to and is intended for the use of only the individual(s) to whom it is addressed. If the reader of this message is not the intended recipient, you are hereby advised that any dissemination, distribution or copying of this message is strictly prohibited. If you have received this message in error, please immediately delete.

![]()