|

We all know Jason was the screen villain who wore a hockey mask and scared all the campers in the Friday the 13th saga. But what was his last name? A. Kreuger See the answer below! |

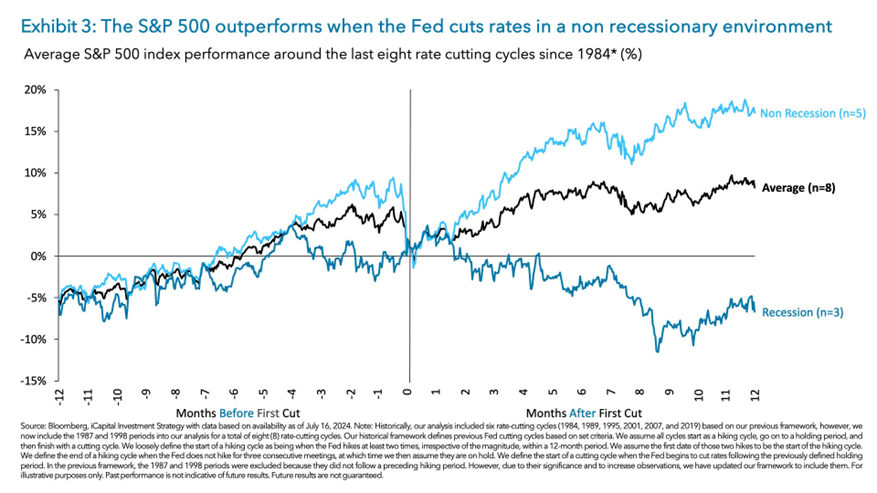

While the history of “13” and its unlucky connotations can be traced back to several religious connections, the inclusion of “Friday” is a bit more obscure. One popular origin story stems from the arrest of the Knights Templar by officers of King Philip IV of France on Friday the 13th in 1307.1 Regardless of the origin, Friday, September 13, capped off a strong week for global equity markets, with the S&P 500 finishing up over 3%. This was largely driven by expectations of a reduction in interest rates by the U.S. Federal Reserve this week. Coming into this year, economists anticipated six or seven rate cuts. Yet here we are in September, awaiting the first cut in almost two years. Despite the Core Consumer Price Index report last week, which was slightly higher than expected due to seasonal demand for airfares and hotel lodging, the overall trend in inflation nationally continues downward. The three-month annualized rate of core inflation is now at 2.1%. With a more accommodative monetary policy, the focus of markets shifts towards the state of economic growth in the United States. As James Carville famously said, “It’s the economy, stupid.” From here on, how the economy responds to easing monetary policy will be the key determinant of market direction. This is particularly evident when looking at the divergence of market performance in the last eight rate-cutting cycles since 1984. The key question is whether the United States will experience a recession in the next 12 months once rate cuts begin. Fortunately, the economy appears to be on solid footing. Unemployment remains well below historical averages, and GDP is projected to be in positive territory for the third quarter, according to the Atlanta Fed GDPNow estimate. While job growth has slowed, job “erosion” (measured by layoffs and initial unemployment claims) will provide the best real estimate of the state of labor markets and the economy. The next indicator that will attract our attention is third-quarter earnings. Although we are still roughly a month away from earnings season, it will provide critical insights into the state of corporate earnings and overall demand heading into 2025. Negative earnings revisions for Q3 remain minimal, but more important will be commentary from management teams regarding the outlook for fourth-quarter earnings, which continue to forecast aggressive growth assumptions. |

|

“It’s the Economy, Stupid” Source: Bloomberg, iCapital Investment Strategy |

|

B. Voorhees |