We all recall the famous opening line from Charles Dickens’ novel “A Tale of Two Cities”: “It was the best of times; it was the worst of times.”

In “A Tale of Two Tapes” we’ll dive deeper into the market dynamics, economic resilience, and upcoming employment data that are shaping the investment landscape.

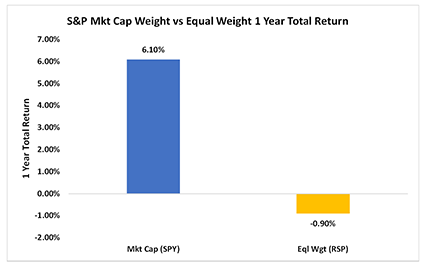

Let’s first take a look at the narrowness of the market. In the last year the S&P 500, market capitalization weighted, is up 6.1% using the SPY ETF as a proxy; while the equal weighted S&P 500 is down 0.9%, using the RSP ETF as a proxy.

The rally in the five most weighted names in the S&P 500, which constitute over 20% of the market capitalization weighted index, is driving a majority of the rally in the S&P 500 while broader measures of market breath show a less robust rally below the surface given concerns over the debt ceiling, the path of inflation, as well as interest rates for the remainder of the year.

Economic activity in the US continues to show resiliency as indicated by the composite PMI report last week. Services in particular continue to support overall economic activity in relation to expectations.

Indicators of inflation continue to be “stubborn” in their refusal to move lower. This backdrop clouds the path of interest rate policy going forward with market expectations continuing to anticipate a pause in further increases for the remainder of this year.

Employment data out this week will be critical for evidence that the labor market is cooling and in turn easing inflationary wage pressures. Initial jobless claims last week were below expectations. Minutes from the May meeting released last week show some division on policy going forward which then points investors in the direction of data coming out to form expectations for future moves.

- Economic Activity – Economic activity in the US continues to be resilient with last week’s US PMI’s better than expected at 54.5 lead by US Services.

- Semiconductors – Nvidia raised its full year forecast on the back of continued momentum in artificial intelligence investment. Semiconductors broadly benefitted and the 30% surge in Nvidia stock lifted the S&P 500 and Nasdaq.

- Debt Ceiling – Congress got closer to solidifying a debt ceiling deal ahead of the June 1st “x-date”. The deal potentially addresses the debt ceiling for the next two years.

Monday

- US Markets Closed

- No Significant Non-US Data

Tuesday

- Eurozone Economic Sentiment

- Eurozone Consumer Confidence

- US Case Schiller Housing Data

- Chinese PMI

Wednesday

- Japanese Consumer Confidence

- German Inflation

- US JOLTS Labor Survey

- Chicago PMI

Thursday

- German Retail Sales

- Eurozone Inflation

- Eurozone Unemployment

- US Challenger Layoffs

- ADP National Employment/Payrolls

- Initial Jobless Claims

- US Unit Labor Costs

- ISM Manufacturing PMI

Friday

- US Employment / Non-Farm Payrolls

A Tale of Two Tapes

Source: Y Charts