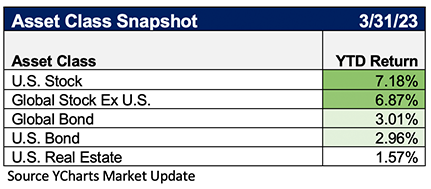

Another quarter is in the books and it was an eventful one to say the least. Before we get into what happened I thought I would share a chart of asset class returns for the quarter that you might find surprising.

Surprised? This quarter was a great case study in how stocks can go up even in the midst of bad news. So, let’s take a look at what happened, starting with the story that has been driving markets for over a year now… inflation and interest rates.

Surprised? This quarter was a great case study in how stocks can go up even in the midst of bad news. So, let’s take a look at what happened, starting with the story that has been driving markets for over a year now… inflation and interest rates.

Inflation and Interest Rates

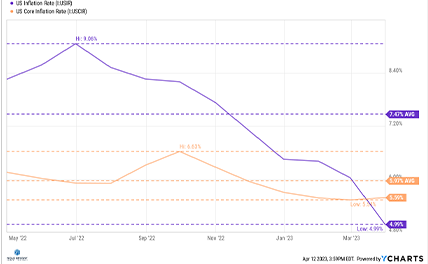

The good news for inflation is that we have gone from a high of over 9% in the Consumer Price Index (CPI) to 4.99%. The bad news is that the rate of disinflation in Core CPI (headline CPI excluding food and energy) has stalled over the last few months.

The good news for inflation is that we have gone from a high of over 9% in the Consumer Price Index (CPI) to 4.99%. The bad news is that the rate of disinflation in Core CPI (headline CPI excluding food and energy) has stalled over the last few months.

If you look at Core CPI, you can see that the rate of disinflation has slowed drastically over the last couple months. There are reasons to be optimistic that the rate can get into the 4-4.5% range, such as the path of rent prices, but getting to the Federal Reserve’s 2% goal will be a major challenge.

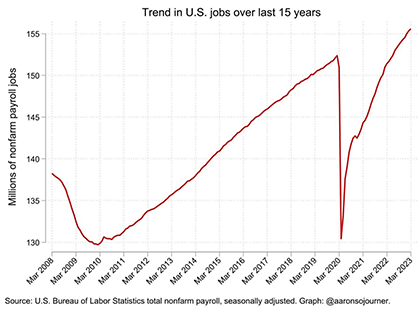

The Federal Reserve has two major jobs: keep prices stable (inflation) and make sure as many people have jobs as is economically feasible.

As you can see from the chart above and the fact that the unemployment rate is currently near all-time lows at 3.6%, they can feel good about one of those two jobs. However, as you know if you’ve been to a grocery store or gas station in the last year and a half, there is still a lot of work to be done on the inflation part. This dynamic has led the Federal Reserve to essentially hike rates aggressively to combat the inflation dynamic, while keeping an eye on jobs and other parts of the economy, to make sure nothing was breaking. Up until March, they could feel pretty good about doing minimal economic damage other than in specific sectors, such as real estate and technology, in their battle against inflation.

As you can see from the chart above and the fact that the unemployment rate is currently near all-time lows at 3.6%, they can feel good about one of those two jobs. However, as you know if you’ve been to a grocery store or gas station in the last year and a half, there is still a lot of work to be done on the inflation part. This dynamic has led the Federal Reserve to essentially hike rates aggressively to combat the inflation dynamic, while keeping an eye on jobs and other parts of the economy, to make sure nothing was breaking. Up until March, they could feel pretty good about doing minimal economic damage other than in specific sectors, such as real estate and technology, in their battle against inflation.

Banking System Concerns

One week in March changed everything- with the news of Silicon Valley Bank’s failure, First Republic’s troubles, and then the ensuing stresses at other banks. There were a lot of problems that were unique to Silicon Valley Bank, but overall, there is a fundamental problem facing all banks in the wake of the Fed raising rates from 0-0.25% to 4.75-5% in just over a year.

Think about banks getting a bunch of deposits in 2020 and investing their portfolio in treasuries and mortgage-backed securities yielding 1% or less. Fast forward a couple years and banks now have customers demanding 5% yields on CDs and higher yields than they are prepared to offer on savings accounts, despite portfolios still holding many of those 1%-yielding securities. Some banks managed these risks well, but others, such as Silicon Valley Bank, went all in on buying long-term securities at low interest rates.

Now, if you recall from how we’ve previously talked about bonds, banks holding bonds at a loss isn’t a problem in and of itself. A bond with a par value of $100 that is trading at say, $80, is no big deal because if you hold it to maturity, you get your $100 back. The trouble happens when fear spreads and you get an “It’s A Wonderful Life” style bank run (but much faster in the age of modern technology), and all of a sudden banks have to either raise capital or liquidate those securities that are at major losses in order to cover their liabilities.

Quickly, the Federal Reserve stepped in to alleviate the stresses by doing things such as guaranteeing all deposits at the insolvent banks as well as setting up a program to offer par value for those securities that banks were having to sell below par. These actions helped stop the game of musical chairs (where people were moving their deposits around), by giving depositors confidence that their money was safe.

If you look at the Federal Reserve’s actions since the SVB situation, I believe the takeaway is that they are aware of the risks of continuing to raise rates aggressively, and yet they likely feel more confident in the tools they can use to fight banking system risks than they do in their ability to crush inflation without crushing the economy in the process.

It’s my view that while the Federal Reserve is most likely near the end of the hiking cycle; it will remain more committed to tackling inflation than a lot of people think, even if it means resuming hikes if inflation stalls in the 4-5% range. Inflation will be defeated in this cycle, but the question is whether the Fed can do it through orchestrating a soft landing or whether they will go too far with their rate hikes and disinflation will come by means of a recession and higher unemployment.

Despite all the negativity, there remain reasons for optimism. Inflation persists but is much lower than it was six months ago, and a recession remains a real possibility, but is far less of a certainty than it was six months ago. The Federal Reserve has raised rates dramatically while keeping the labor market largely intact (other than some specific sectors, such as technology). Mortgage rates have come down a bit and we are starting to see some signs of life in the housing market- both as the activity of homebuilders picks up, and with residential real estate prices beginning to stabilize.

Finally, from a psychological perspective, it’s often when the news is the worst and the rally feels unsustainable that markets have their best runs. 2009 and 2020 are recent examples of the phenomenon where, in the wake of an adverse financial event, everyone is negative and yet the market rallies. In both years, as the market rallied further, everyone was so confident it had to crash again, and yet the market remained resilient, even in a volatile economic time.

2023 will likely have elevated volatility and I’ve been humbled from my time in the industry to not make any precise predictions, but I do know that just because risks to the market are everywhere and negative news is on the TV, that doesn’t mean it has to be a bad year for markets. If anything, 2009, 2020, and Q1 2023 prove that often the opposite is true.